For the closing week, the Dow Jones industrial average ended the week down 50.57, or 0.59%, at 8,579.11. The Standard & Poor's 500 index finished up 8.15, or 0.93%, at 887.88. The Nasdaq composite index ended the week up 23.60, or 1.53%, at 1,564.32.

The Russell 2000 index finished the week up 17.83, or 3.8%, at 486.26. The Dow Jones Wilshire 5000 Composite Index — a free-float weighted index that measures 5,000 US based companies ended at 8,924.03, up 123.85 points, or 1.41%, for the week. A year ago, the index was at 14,644.64

What fundamental news we have that week?

On Tuesday the US Federal Reserve's decision to cut interest rates to near zero percent, a record low, and its promise to buy up more debt to rejuvenate the housing market and on Friday, the White House make a decision to lend U.S. auto makers up to $17 billion.

The Fed Zero Interest Rate Policy (ZIRP) cut the rates to the lowest level in the world and below the Bank of Japan rate of 0.30%. With ZIRP the Fed will applied the quantitative easing (QE) policy.

Quantitative Easing or ZIRP has only ever been implemented once in Japan during what came to be known as its "lost decade.'' A gigantic real-estate boom in the 1980's came crashing down in 1991, bringing many other prices with it. Efforts to restart the economy foundered time and again, as businesses were not able to generate the kind of profits that would reignite prosperity's cycle of hiring and spending. The Bank of Japan embarked upon this new concept of ZIRP to fight a frustrating period of economic stagnation and decline from the 2001 to 2006. The ZIRP was implemented to fight the wave of deflation. Deflation, another modern economic term, is an overall decline in prices over an extended period of time. The cause of the deflationary phenomena is when consumers become so resistant to spending that sellers are forced to continuously cut prices.

The word “Quantitative” refers to the money supply and easing money supply means to increase it. It basically involves increasing the money supply by printing money to buy a variety of securities with the end goal of flooding the financial markets with cash or liquidity thereby increasing the amount of currency in circulation which reduces the value of the currency and boosts inflation.

In the first year of Quantitative Easing, USD/JPY rose 18.5 percent. This means that the Japanese Yen weakened against the US dollar, which is a textbook reaction to Quantitative Easing. The Nikkei also dropped 28 percent. Between 2002 and the end of 2004, USD/JPY fell 22 percent as the Japanese economy began to stabilize. During that same time the Nikkei recovered 20 percent, but not before it fell another 20 percent.

Since than the ZIRP or QE policy has been heavily debated whether the policy lead to the turnaround of the economy. Most of the US economists and market commentators were against the Fed’s ZIRP . Time will tell.

Last week, the ZIRP announcement lead the stock market higher, but the next two days the market were moving southward on problems face by the automakers and the senate reluctant to extend any financial support to them. By Friday morning with US President announcement of a $17.4 billion rescue package for the troubled Detroit auto makers that allows them to avoid bankruptcy, the market recovered. But before noon the markets turned around and closed near to last week close.

Refer to the chart of 15 min Dow Jones Industrial Average (DJIA) below.

DJIA opened on Monday above the daily pivot point (pp) but it was contained by the 60 and 200 EMA’s and the weekly and monthly pivot point.

DJIA opened on Monday above the daily pivot point (pp) but it was contained by the 60 and 200 EMA’s and the weekly and monthly pivot point.On Tuesday it opened at daily pp, went up to and breached the 20, 60 and 200 EMA’s and rested at the weekly and monthly pp for more than 4 hours before moving upwards on ZIPR. The next day it tested the previous day high, failed and moved southward for a double top pattern. The target downward was reached at about the daily support S-1.

Friday, the news of USD17.4 billion handout to the automakers pushed the market temporarily upward but could not sustained the uptrend as reflected by the sharp fall in the blue lag indicator below 85 level with the red lag remain below the 15 level reflecting a bearish stance for the near term.

Overall, the market new lows have remained at benign levels with no new highs. The secondary indices have been stronger than the blue chips. Will there be a Santa Claus rally. The second and third days prior to Christmas are often a little weak, but the day prior to Christmas is usually strong. The day after Christmas i.e. Friday, there is likely to be a very low volume day that drifts upward, similar to the day after Thanksgiving.

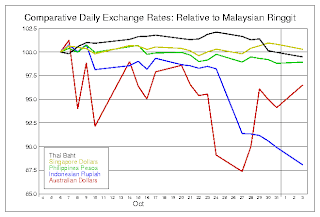

For the forex the big mover is the US dollar.

The U.S. Dollar finished the week with a loss against all major currencies.

The Euro traded sharply higher after the Fed ZIRP. The news of the ZIRP came after comments by ECB President Trichet hinted that the ECB would not lower rates in January. Trichet’s comments and the Fed ZIRP triggered a massive rally in the Euro which took the market to a better than 62% retracement of the entire break from July to October. Crunching the numbers, the euro’s rally was the biggest since the currency began trading nearly a decade ago.

For USD JPY plunged sharply lower after the Fed cut rates. The rally in the Yen was relentless causing the Japanese government to encourage action by the Bank of Japan to halt the vicious rise in price. The government is concerned about the damage the high priced Yen is doing to the economy. Japan Finance Minister Nakagawa told reporters on Thursday that he is "keenly watching" currency markets. He also stressed that he has "the means" to take action against the rise in the Japanese Yen. The Yen plummeted after his statements as traders reacted by selling the Yen in anticipation of an intervention. Instead of intervening, however, the Bank of Japan surprised everyone by cutting its key interest rate to 0.10% on Friday. Traders reacted to this announcement by buying back the Yen, a sign that a rate cut would have less impact than an intervention. Although the USD JPY did not fall back to the low for the week, there was enough selling activity to signal that the BoJ may have to intervene to push down the value of the Yen.

The EURJPY was on the uptrend up to Thursday before the European session in line with the strength of euro as against the major currencies. The chart below is the 15 chart of EURJPY.

The uptrend was well supported by the 200 period EMA and the daily pivot point. On Thursday, the euros spike up and revert back down immediately against the yen and the dollar after the first hour of London session when the European Central Bank announced to re-widened its interest rate corridor through reducing the deposit rate from 100 to 50 basis points to revive interbank lending.

The uptrend was well supported by the 200 period EMA and the daily pivot point. On Thursday, the euros spike up and revert back down immediately against the yen and the dollar after the first hour of London session when the European Central Bank announced to re-widened its interest rate corridor through reducing the deposit rate from 100 to 50 basis points to revive interbank lending.